For many, 2023 was a year of fear. Stubborn inflation, recession worries, and international conflict hung like a cloud over the US and the rest of the world. Despite a gloomy backdrop, the US economy proved more resilient than many expected, and there’s a stronger sense of optimism in 2024’s business outlook than there was at the start of last year.

In the payments space, we see continued innovation in 2024, particularly when it comes to reducing payment friction with digital solutions. There could also be increased regulatory activity to adjust to new solutions like AI and cryptocurrency. Winners in this space will be the payment processors and businesses that most quickly anticipate and integrate new product offerings.

Let’s talk about what may be in store for 2024, how COCARD is gearing up for the year, and how you can succeed no matter what cards the year deals us.

The Recession That Wasn’t

Since early 2022, the cloud of a coming recession has loomed over the economy. Economists, especially in 2022, largely expected that a recession was just around the corner. Two years later, the economy continues to chug along. Consumer sentiment has rebounded, and GDP has continued to grow since the pandemic.

Economists still mostly expect 2024 to be softer than ’22 or ’23, but they are no longer predicting the painful recession that they did in those years. Generally, they expect slowing job and GDP growth but fall far short of predicting a recession a la 2008 or early 2020. A big part of their cautious optimism stems from inflation finally coming back down, which means that interest rates will likely come down with it in 2024.

Regulation, New Tech, Decision ’24

The regulatory landscape will have to contend with fast-changing technologies, particularly in the payments space. The government is walking a fine line between regulating tech like cryptocurrency and artificial intelligence, without stifling it. Experts expect higher regulatory activity in these areas, as well as the expectation that companies will do their part to better safeguard their clients against fraud and other threats.

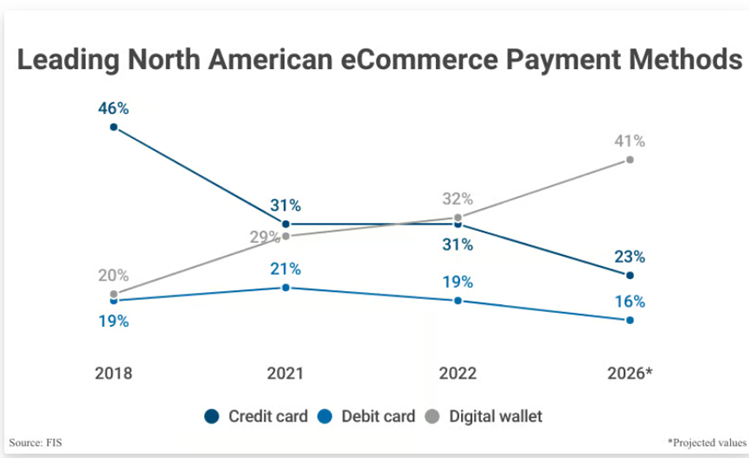

Source: CapitalOne

One trend that should continue is the shift toward digital wallets. According to Capital One, digital wallets are set to be the most common online payment method by 2025. More and more businesses are offering these payment options in physical stores as well. Digital wallets make transactions easier and often more secure by limiting the direct exchange of bank or card information and also make cross-border payments more efficient.

As cryptocurrency continues its dramatic price recovery, crypto payment products will likely make it back into fashion. Credit cards offering crypto rewards, and accepting payment in crypto, should rebound in popularity in 2024, particularly if the crypto rally stays strong.

Of course, this year’s presidential election is one of the biggest factors driving business outlook. While President Biden will remain in office for all of 2024, the election in November is sure to drive sentiment and captivate the country’s attention.

Where Will Rates Go?

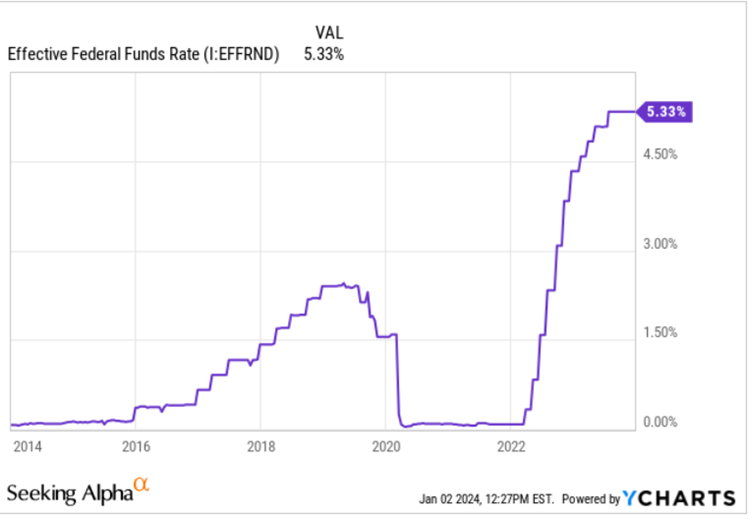

Any prediction about what will happen next year, from the business outlook to the stock market to even the outcome of the 2024 election, largely hinges on what will happen with interest rates. In response to high inflation, The Federal Reserve has kept rates at the highest level since the early 2000s.

High-interest rates are designed to bring down inflation, but they also dampen business and investment activity. From 2008 to 2022, low inflation allowed the Fed to keep rates very low to boost the economy, but they’re over 5% today. Those high rates trickle down to consumers, making everything from credit cards to mortgages more expensive.

Interest Rates are likely to come down in 2024

At the beginning of 2024, inflation is much lower than it was a year ago. That gives the Federal Reserve room to bring down interest rates this year. It has indicated that it plans to cut rates next year, welcome news for most investors and businesses.

Of course, the world is about as unpredictable as it’s every been. International conflict and other crises can quickly derail supply chains, and that would bring inflation right back onto the minds and wallets of Americans. Additionally, low rates won’t save the economy from pain if a big recession hits. More important than reading the tea leaves, or praying for a rosy economy, is to build a business that can thrive in any climate.

Shine in Any Weather

It’s important to study the data and forecast the future, but ultimately, we should build a business that does great no matter what the broader market does.

The most important thing for a payment processor is to lead in tomorrow’s technology. This is especially true in recent times, with consumer preferences and available payment options changing every day. Customers want the option of traditional payment options in addition to new solutions, such as pay-by-link and digital wallets.

To this end, COCARD is partnering with MiCamp to expand and strengthen our payment network. The alliance, which includes a partial equity stake in COCARD, will expand our reach to over 46,000 merchants, processing transactions of over $40 billion in value. We’ll continue to offer a best-in-class payment suite to our merchants and the clients they serve and will lead the industry when it comes to integrating new options.

At COCARD, we know that the only way to lead in the Digital Age is to embrace change and put our clients first. Get in touch today to supercharge your payment suite!