Picture this: a customer comes into your store, grabbing several items that catch their eye. When they approach the counter to pay, they discover that you only accept cash. Disappointment washes over their face, they replace the items and walk out. If you’re still not taking cards, you’ve likely had a few moments just like this one.

You didn’t just miss a sale; you might have also lost a loyal, lifelong customer. Accepting cards will boost your sales, there’s no question about it. Nowadays, however, businesses need to do more than take cards.

In our increasingly digital world, consumers expect a smooth, hassle-free payment experience, regardless of the channel they shop through. Whether online or in person, buyers want you to take what they have. Embracing omnichannel payments, which encompass not only credit cards but a whole lot more, has become crucial for succeeding in the Digital Age.

What Omnichannel Payments Mean for Your Business

When we say “omnichannel”, we’re talking about accepting payments across multiple platforms – in-store, online, mobile – and through a variety of methods, beyond just cards.

The humble credit card, secure and convenient, has long been a mainstay payment option. But today’s modern customer craves more than just plastic. She wants the option to pay by link or QR code, PayPal, or her favorite mobile wallet. You may be surprised by what research says it could do for your business.

Cash’s Crash

Customers Move Away from Cash, Embrace Digital Wallets

Chart: COCARD, Source: Statista

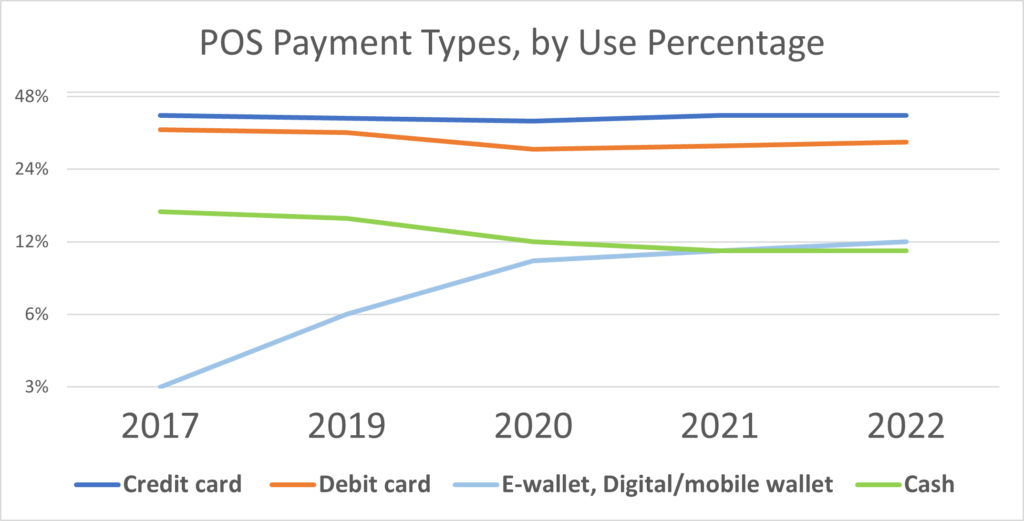

Cash payments have been on the decline for some time, and the trend accelerated during the pandemic, as customers moved toward more hygienic payment options. As the chart shows, digital wallets have now passed up cash as the third most common payment method at POS checkouts. That’s good news for your bottom line!

Studies show that customers tend to spend more when they pay with methods other than cash. One key reason for this is that card payments often feel less ‘real’ compared to handing over physical cash. This psychological effect can make customers feel more at ease about a little extra spending.

Another more intuitive reason is that customers simply don’t carry cash like they used to. They prefer cards and mobile wallets because they’re more secure, convenient, and hygienic. They also buy online, which of course is nearly impossible to do with cash.

By offering more payment options, you not only make life easier for your customers, but you also make it easier to say ‘yes’ to that extra purchase.

New Frontiers: QR, Pay-By-Link, and Digital Wallets

In the evolving commercial landscape, businesses are expanding their horizons to include innovative payment methods like QR codes, pay-by-link options, and digital wallets. While classic forms of payment are still essential, these newer alternatives are quickly gaining traction.

QR codes offer speed and efficiency. They can be securely scanned on any mobile device for a quick checkout. Pay-by-link options have similar advantages, allowing customers to transact anytime, anywhere with a simple click on a payment link sent via email or text message. Digital wallets like Apple Pay and Google Pay offer secure, contactless transactions using smartphones or other devices.

By incorporating these options into your payment suite, you’re not only providing additional convenience to your customers, but you’re demonstrating that your business is forward-thinking and customer-focused, adapting to the changing face of commerce.

It’s 2023. Time for a Digital Storefront

In today’s business landscape, a digital storefront is as important as a physical one. Customers should be able to make purchases on your website as easily as they would in your store.

This includes having a variety of payment options. Digital wallets, PayPal, and card options should be integrated into your digital storefront. With QR code and pay-by-link options, customers can make quick and secure payments, even if they are not physically present in your store.

Security and Trust

Diversifying your accepted payment methods isn’t just about accommodating your customers’ preferences; it’s also about providing them with secure alternatives.

Many newer payment methods, like digital wallets and mobile payments, come with sophisticated security features that protect your customers from potential fraudulent activities. This is especially true when you partner with a payment processor that has your back.

Enhanced security not only increases your customers’ trust in your business, it ensures smoother transactions and fewer fraud-related losses.

The COCARD Advantage

In an ever-evolving business landscape, flexibility and adaptability are key. Embracing Omnichannel payments is no longer optional, but a necessity for survival and growth.

Since its inception, COCARD has led in the industry in adopting new technologies that add value and security to the payment experience. We understand the need for diverse payment options, and the platforms to support them. Our Omnichannel payment solutions are designed to meet the demands of today’s consumers. Get in touch today to learn how COCARD can supercharge your business!